Consulting

Pharma Contract Sales Issues

Prepared by Dr. Alexander Werner. KB# 10003.

This article is based on a case study presented by Dr. Alexander Werner at the conference on “Chargebacks and Commercial Rebates” by the American Conference Institute, New York. The study used Pharma Suite software, developed by Relasoft Solutions Inc.

1. Introduction

A large portion of sales in pharmaceutical industry is conducted indirectly through wholesalers. GPOs enter into contract agreements with a distributor and sets contract prices for the products GPO members want to buy. This contract information is eventually loaded to all or some wholesalers buying from that distributor, and customers get their contract prices when they mention the contract at the time of purchase. Wholesalers acquire their products from the distributors at Wholesaler Acquisition Cost (WAC).

In a nice and profitable world, WAC for each NDC would always be greater than contract price, which, in turn, should always be greater than the product cost:

WAC > Contract Price > Cost

In a real life, however, when the number of active NDC is growing as well as the number of vendors, this rule does not always stand, and various pricing errors creep in. The following issues can happen on one or many NDCs:

WAC < Contract Price

WAC < Product Cost

Contract Price < Product Cost

The reason for all these errors to occur is simple: the volume of changes is too high to handle without most sophisticated and fully automated validation tools. Factors contributing to the high volume of changes are:

- long product list

- multiple vendors with different costs

- GPO pricing varies

- All prices and costs change over time

Our company conducted a research on the dynamics of pricing in order to detect the frequency of such data errors, and to evaluate their overall impact on the bottom line. The research was made on sales and chargeback processing data, as well as on pricing and cost histories, collected for five years.

2. Case Study Review

Case study includes two parts:

Part 1. Evaluation of the frequency of changes

Part 2. Quantifying the losses

The pharmaceutical distributor selected for our case study runs on multi-level cost models, with various costs reflecting different levels of discounts, received by purchasing. The research used the lowest “net” cost. All changes in product pricing and costs were monitored and logged. Contract pricing history remains always available.

The distributor may carry multiple products with different SKUs for one NDC. Items are coming from different manufacturers, separate SKUs are created for short-dated items, older products get discontinued and new ones are introduced. Each item has its own costs and pricing scheme. The ERP system is supposed to ensure that all sales to wholesalers are done at WAC.

Here are some general parameters:

| Number of current wholesale contracts | 163 |

| Count of NDC, participating in all wholesale contracts | 1,386 |

| Count of contact lines, setting contract price per NDC for date ranges | 147,642 |

| Maximum number of products for one NDC on different contracts | 5 |

| Average number of products for one NDC on different contracts | 1.3 |

The pharmaceutical distributor of our case study has 163 currently open contracts with GPO and 1,386 active NDC included into the current contracts.

Contract line sets a contract price for one NDC for some time period. Not all NDC are included into each contract, roughly 2/3 of them.

Knowing the number of active NDC and current GPO contracts, one can easily estimate the number of contract lines for his/her company.

In our case, each NDC is presented on average by 1.3 products, with the maximum of 5 products. Now let’s review the dynamics of changes.

2.1 Frequency of Price and Cost changes

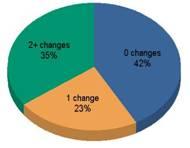

The following chart shows WAC changes per NDC over 5 years period.

Only 40% of NDC retained the same WAC price for over 5 years. 60%, which is 800 NDC, had it changed at least once, and each third NDC, roughly 500, had it changed twice or more.

Maximum number of WAC changes per NDC was 8.

Each decrease in WAC may come into a conflict with either contract price or product cost on items with that NDC.

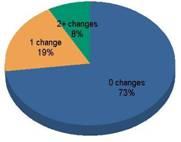

Changes in contract price per NDC are show below:

The changes in contract price show that only a quarter of products on a contract will have its price changed within the contract term and yet this quarter means tens of thousands contract terms (40,000 out of 147,000).

Some NDC with issues had 14 changes of contract price during the contract term. Be it because of operator’s mistake or not, a change is a change and a loss is a loss.

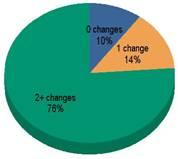

The last chart shows product cost changes:

In comparison, changes in Product cost happen in 90% of cases, in roughly 1,200 (179+999) products out of 1,300 (1,308).

Maximum number of costs for four products with the same NDC was 50!

While the contract price is relatively stable for the contract term, the product cost is highly likely to change, either due to the change of price of the existing product, or due to the new product with the same NDC coming to the market.

Changes in product costs demand comparison against both WAC and contract prices on ALL contracts.

Without efficient validation tools, limiting the number of exceptions submitted for a review to a minimum, the chargeback administrators will be overworked and the pricing will not be accurate.

To summarize part 1:

WAC changed for 50+% of NDC

Contract price changed for 20% of products/terms

Product Cost changed for 90% of NDC

Number of lines to watch, up to:

Number of NDC x Number of Contracts

Knowing these ratios and the number of NDC and contracts, one can estimate the number of lines to monitor.

In our case study, the distributor had the required validation tools in place and regularly executed on-demand. Now let’s find out the losses caused by the pricing errors.

2.2 Quantifying the losses

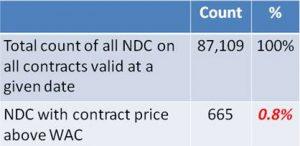

To start, let’s look into cases of WAC being lower than the Contract Price.

As we see from the table, this type on an error happens in 0.8% of pricing conditions set on NDC level.

At the time of purchase, GPO member won’t pay the price higher than WAC. Rather, that member will either buy that product at WAC, buy it at the wholesaler “source” contract, or get a different product. On a first glance, there is no financial loss involved, isn’t it? Unfortunately, this is not so.

Wholesaler may charge rebates on an item that was purchased on the “source” contract, which would not be paid for the sale at the proper contract.

If an item was sold at WAC, wholesaler will not submit a chargeback request, and all the marketing information about the customer and his purchases will be lost. Submitting zero chargebacks did not become a standard practice in the pharmaceutical industry.

In addition to that, the sale to an unknown customer will result in extra CMS rebates going to states due to two factors: firstly, that sale at WAC will be considered as CMS-eligible even when made actually to CMS-ineligible customer, bumping up the AMP. Secondly, this sale will increase the limit of units to approve when validating the CMS invoice submitted by the state.

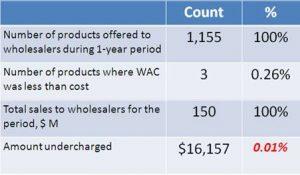

Now we will look into cases of products with WAC set to below Cost.

No matter how ridiculous this sounds, the errors of this type may happen, though relatively not often in the environment where validation checks are run regularly, please see the table below.

Cases of WAC being lower than product result in direct money loss. Investigation showed that 99% of losses were caused by incorrect pricing on only one product sold to wholesalers below cost for three months, before the error was corrected. It did not take long to lose a few thousands of dollars on just several transactions.

Finally, we will review cases of products where their contract price on some products is below cost.

This type of pricing discrepancy also results in direct loss: 0.04% of contract sales were lost due to multiple pricing errors. Interesting to note, that 83% of all losses happened on government contracts. This is not a wonder, considering that FSS contracts were regularly verified to ensure that FSS pricing is the best pricing offered. (I hope every company has mechanisms proving FSS pricing is the lowest, and suggest that that mechanism could be handy for not only for general price verification, but for government compliance as well).

All the above numbers were found for a company where pricing validation tools were put in place and frequently used. One may ask: what happens at a pharmaceutical with no such pricing checks deployed? William Shakespeare, if distracted from his work on “Romeo and Juliet”, would probably answer something like:

“For never was a story of more woe

Than this of contract sales kudos”.

Our validation tools showed yearly lossesof several hundreds of thousands of dollars and over $500.00 lost on a single invoice line. Errors started to appear on systems with as little as twenty active NDC and ten active contracts.

Assuming Net Profit to be 10% of sales, we get that up to 0.4% plus 0.1% = 0.5% of Net Profit on contract sales is lost.

To conclude Part 2: when pricing validation tools exist, but are executed on demand, rather than being automated, the study discovered:

Up to 0.5% of Net Profit is gone

Errors costly even on a short term

Extra customer rebates

Extra CMS rebates

Marketing information is lost

Losses on system running without pricing checks can be called “tragic”.

3. Summary

The conclusions of the study are:

Pricing errors lead to significant money and data losses even when the on-demand validations tools are in place. Pricing errors can be costly even over a short time. Money and data is lost. 0.5% of lost Net Profit is not something one wants to live with.

Checks must rely on tight systems integration and reflect business specifics. Tight integration between sales and chargeback data is critical in building proper pricing validation. The pricing check must be smart enough to exclude all old and inactive products from triggering the alarm, as well as products not sold to wholesalers. Otherwise the large number of items on the report can make the report unusable.

Pricing checks must be intelligent, proactive and automated. Checks have to be pro-active and validate pricing for some future. Exceptions have to be emailed to the proper people to take care of them before errors turn into losses.

To find out more about the pricing monitoring tool, please contact Alexander.

Alexander Werner, Ph.D, is a founding partner and the chief software architect for Relasoft Solutions Inc, the company specializing in software for Healthcare Management industry. Relasoft main product Pharma Suite includes modules to process several typical tasks in the pharmaceutical environment: Chargebacks, Rebates, MDRI and Coverage Gap Discount program for Medicaid, Sales Commission, Business Intelligence and reporting systems.

Here are the links for more info on Pharma Suite and to contact Alexander.